Understanding the core revenue streams of your farm is vital for strategic planning and sustainability. It enables informed decision-making on resource allocation, investment, and diversification. By identifying profitable avenues, farmers can optimize operations, mitigate risks, and adapt to market fluctuations, ensuring long-term profitability and resilience in the agricultural sector.

In The Farmer’s Office, Julia Shanks helps farmers identify these key financial elements and clarifies the path to profitability in farming. On the blog today, in an excerpt from the second edition of The Farmer’s Office, Julia wants to know if you know what makes your farm money, and why….

Do you know which farmers market is most profitable for you? Do you know if you’re making a profit on your chickens? You may have a gut instinct. But how bummed would you be if you realized that you were incurring losses on the meat birds? While you may be tracking that your sales are greater than your expenses (i.e., you are running a profitable business), it could be that some of your products are losing money. If you don’t track your revenues and expenses effectively, then you don’t know for sure.

Brett Grohsgal of Even’ Star Organic Farm in Southern Maryland launched his business thinking he would be the “Tomato Man,” and grew 60 varieties that were truly vine ripened. After four years in business, things were going well; he started diversifying his crops and selling through a CSA model, but he knew he could do better. After eight years in business, we sat down with his books. We went through every expense and every sale as it related to each crop. We figured how much time he spent propagating seeds, sowing, weeding, harvesting, and sorting. We calculated the cost to produce a case of tomatoes that he sold for $30. When he factored in all the labor and production costs, he was netting only 12 cents a case! Cucumbers, okra, and sweet potatoes, on the on the other hand, were cash cows. He knew that no amount of tomato sales would be sufficient to run a profitable farm; if he wanted to stay in business, he needed to further diversify his vegetable offerings and limit tomato production.

Invest In Your Business

Can you afford to purchase a greenhouse or to hire employees? Is that tractor in your budget?

Hannah and Ben Wolbach of Skinny Dip Farm were overworked and understaffed. They barely hired any help because they “had no confidence in their ability to forecast for even one season ahead.” They weren’t sure if they could afford the added expense.

By creating a cash flow budget, they had the confidence to grow their business and hire staff because they could project the impact of payroll expense on their profitability.

Plan For Growth

What’s the best way to grow your business? Should you expand current operations or diversify your offerings? Can you afford the loan that will help finance your plans?

Wingate Farm in New Hampshire wanted to devise a strategy to grow its business. They were raising meat chickens, layers, and vegetables. After their first year, owners Susan and Olivia had an $8,000 profit. They were pleased to have earned a modest profit but also knew they needed to do better to grow a sustainable business. They questioned where to focus their attention. Similar to the analysis Brett did, Susan and Olivia combed through their detailed recordkeeping and discovered that, after accounting for their labor, they were earning only 10 cents a bird! Meanwhile, the eggs were netting $1.15 a dozen. These facts informed their strategy—both in terms of focusing on egg production and reconfiguring the meat-bird operation to be more profitable. Wingate Farm demonstrates how effective bookkeeping and understanding your numbers can be in helping you develop a growth strategy—by providing information about the profitability of specific products.

Good bookkeeping can also help you understand whether a new opportunity makes sense and if you can afford the loans that may be needed. Will that new tractor improve efficiencies enough to increase profitability even after you repay the loan that’s required? Does it make sense to restore an old cider press?

With a growth strategy in mind, you need a plan to get there. What investments do you need to make, and how will you finance them?

Kate Stillman of Stillman’s Quality Meats wanted to build her own meat processing facility. There’s no question that having the capability to slaughter and butcher her own chickens, as well as butcher her own quadrupeds, would improve the quality of her product, increase efficiencies, and help differentiate her product from an increasingly competitive local-meat landscape. The real question was, could she afford it? If she took out a loan to build the facility, could she generate enough profit to pay the debt service? Would the improved efficiencies of the processing facility actually reduce her operating costs?

By using sound financial forecasting, she decided the answers to these questions were yes, yes, and yes. And instead of trying to save enough to finance the processing facility, she opted for bank loans and a USDA grant. The banks and USDA wanted to see the numbers and the story behind the numbers (that is, the business plan). With her books in good shape, she had what she needed to apply for the financing.

Plan For Slow Periods

Do you know how to plan for the inevitable ebbs and flows of business and cash? During slow periods (like August or January), cash can be tight. If you don’t plan properly and cash is tight, a few things can happen:

- You charge things to your credit card or take out short-term loans; both incur interest.

- You take unnecessary loans or even high-interest rate loans.

- You fall behind on paying your vendors, and they apply finance charges, demand payments in advance of delivery, and/or refuse doing business with you altogether.

The unnecessary interest and finance charges can be avoided with proper Planning.

A few summers ago, I visited a client, Roberta. She farms outside Washington, DC, and sells primarily to the DC market. During her peak production in August, her customers abandon the city for vacation destinations, and her wholesale restaurant clients decrease their order sizes. Therefore, in August, she has to be especially careful about cash flow. During our visit, I overheard her asking a worker to wait a few days to cash his paycheck. Given that she knows August will be slow, she can plan for it by understanding her cash shortfall, and budgeting for it.

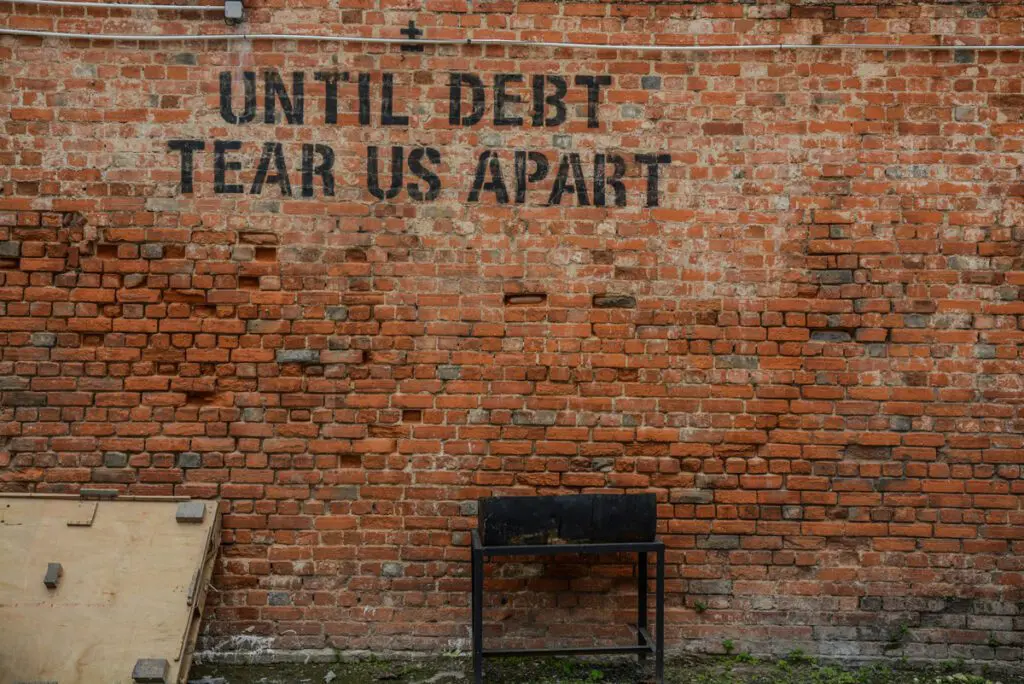

Avoid Out-Of-Control Debt

I started working with Laura Meister from Farm Girl Farm not because she wanted to learn bookkeeping and budgeting, but because debt overwhelmed her. She hadn’t budgeted properly for a couple of years, borrowed more than she could afford to pay back, and got herself in trouble. In order to figure out the right strategy for Laura, we first had to determine the cause of the mounting debt. Was her business financially sustainable outside the burden of debt?

If not, then the increase in debt was resulting from poorly managed operations or a business model that could not succeed. Good accounting records helped her figure out which.

If her base operations were solid, then we would need to dig deeper still. The increasing debt could be because she wasn’t generating enough cash to pay it down or that she paid debt too aggressively when she had cash and then got herself in trouble again during the slow months. We were able to get her books in order so that we could see

- her base operations were profitable;

- the amount of debt she could afford to pay down and when; and

- where she could trim expenses to improve profitability (thereby improving her cash position).

Armed with this knowledge, she could create a plan to streamline operations and pay down debt without compromising her cash flow.

Weather COVID Like Pivots

Is your farm business positioned to withstand an unexpected crisis, like Covid, climate change, or sudden inflation?

In March 2020, Ian from Five Figs Farm had just finished his budget planning and was starting to ramp up his plantings for the upcoming growing season. Like years past, he planned to sell his vegetables through a CSA, to local restaurants, and at his self-serve farm stand. And then Covid. Certainly, people would still need to eat, but he had no idea how his client/sales mix would evolve.

He had already been thinking about investing in his farm stand. It would allow him to increase sales to the local community and facilitate distributing more CSA shares. With all the uncertainty of Covid, he wanted to figure out if he could fast-track the improvements.

Ian already had his budget—so he knew what to expect with labor and production costs. With the additional $10,000 investment in the farm stand, he needed to quickly figure out what kind of sales he’d need to make it worthwhile and whether he would be able to do it with reduced labor. With his numbers already organized, he was able to quickly and easily model several scenarios. If he made the investment, he figured he’d need to sell an additional $15,000 worth of product. He also worried that he wouldn’t be able to find workers for the upcoming season. He wouldn’t have the added payroll expenses, lowering the volume of sales needed to break even, but would he be able to handle even the reduced production with just him and his spouse?

While there was still significant anxiety, he felt a lot better that he could see how it would work with reduced staff and added investment.

Keep Your Eye On The Prize

For many, the end goal in running a successful farm business is to feed the local food system and enjoy a sustainable lifestyle. To get there, you must understand what makes you money, have an understanding of the best way to grow, and have a sound plan before taking on debt. It’s about understanding the nature of your business with all its seasonal variances.

As Susan from Wingate Farm describes it:

So much of farming on a smaller scale is about reacting to situations that require immediate attention. It’s easy to spend all day running around putting out fires. Amidst all that chaos, it’s very easy to lose sight of the bigger picture. Taking the time to think through the big picture when you actually have the brain space/energy is the only way to farm with intention. Then you have a map for your farm and your business plan guides you through the chaos. It allows you to be proactive, instead of reactive.

The goal of this book is to give you the tools to be proactive in how you launch, grow, and manage your business. And should you face a cash or external crisis, you’ll have the skills to evaluate your business and correct your course. This book will cover

- the three primary financial statements (income statement, balance sheet, and statement of cash flows)

- the underlying accounting principles of the three financial statements;

- how to set up your bookkeeping system so you can get the information you need;

- how to use the numbers and information in the financial statements to better manage and grow your business;

- writing a business plan and creating financial projections for a loan or grant;

- the underlying growth strategies of the business plan;

- how to navigate a cash crisis;

- how to pivot and adapt during external crises;

- and developing the entrepreneurial mindset to apply all the above skills to your business.

I know business management, accounting, and numbers can feel scary. But we’ll chunk it down and go step by step. After weaving your own experiences with the concepts in this book, you’ll be able to manage both your fields and your office.

Ready? Let’s go!